R&D Tax Credits: What you need to know

R&D Tax Relief is a Government backed incentive designed to encourage innovation and increase spending on Research and Development activities for companies operating in the UK.

For SMEs, a deduction of 230% of the amount spent on R&D can be made from taxable profits, reducing the corporation tax due. For loss making companies, the scheme allows up to 33.35% of a company’s R&D spend to be recovered as a cash repayment.

However, claims are often overlooked because business owners over-estimate the level of innovation that is required in order to claim, don’t know about the relief or simply suspect that it is too good to be true!

Qualifying projects are those that aim to advance the overall knowledge or capability in a field of science or technology through the resolution of scientific or technological uncertainties. Such projects may create or appreciably improve a process, material, device or product.

This means that a wide variety of business sectors can potentially qualify for R&D relief. It is not just ‘men in white coats!’

For the purposes of R&D tax credits an SME has fewer than 500 staff and either a turnover of less than €100m or a balance sheet of less than €86m. If the company has external investors or has received state aid grants this can affect its SME status. Under some circumstances the company could claim under the separate scheme for large companies instead.

Click here to download your complete guide.

How do R&D tax credits work?

The relief is extremely generous and can provide significant cash-flow benefits which are sometimes vital in the early lifecycle of a business.

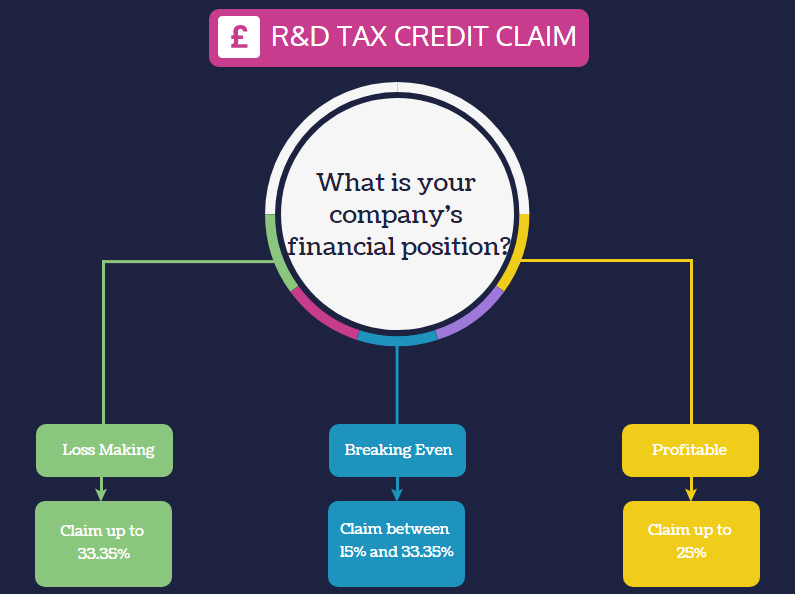

SMEs receive relief of 230% of their qualifying R&D costs, meaning that their corporation tax liability is reduced and loss-making companies can, in certain circumstances, surrender their losses in return for a payable tax credit of 14.5%. This can mean an effective saving of up to 33.35%.

The RDEC regime is less beneficial, however does result in cash back of 10.53% of qualifying project costs. This saving is equally open to both profitable and loss making companies.

What qualifies as R&D?

The work must be part of a project with the aim of making an advance in science or technology. It must relate to the company’s trade, or a trade the company intends to commence.

Common examples of projects that may qualify include:

- Innovative methods of capturing, transmitting, manipulating, and protecting data;

- State-of-the-art software for new projects, or new functionality for existing R&D projects;

- Improvements to programming language;

- Designing, constructing, and testing product prototypes;

- New methods of capturing, utilising or communicating data;

- Developing processes that would meet increasing regulatory requirements; or,

- Streamlining manufacturing processes through automation.

How is R&D tax relief calculated?

Qualifying expenditure on a project includes the following:

- Salaries, employer’s NICs and pension contributions

- Subcontractors

- Software (if certain criteria are met)

- Materials and consumables including utilities

Under the SME scheme, a company can deduct 230% of its qualifying expenditure from profits. As such, an extra 130% is deducted from taxable profits in the corporation tax computation because 100% of the cost will have been deducted in the profit and loss account.

For accounting periods beginning on or after 1 April 2021, the payable R&D tax credit that a loss-making SME can receive will be capped at £20,000 plus 300% of its total Pay as you Earn (PAYE) and National Insurance Contributions (NICs) liability for the period. The cap therefore does not apply for companies whose payable credits is not more than £20,000. A company is exempt from the cap if: the claimant company’s employees are creating, preparing to create or actively managing Intellectual Property (IP); it does not spend more than 15% of its qualifying R&D expenditure on subcontracting R&D to, or the provision of externally provided workers (EPWs) by, connected persons.

Example of a profit-making SME

| Taxable profit (before R&D claim) | £500,000 |

| Corporation Tax liability on profit at 19% rate | £95,000 |

| Qualifying R&D expenditure | £250,000 |

| Enhanced R&D expenditure (130%) | £325,000 |

| Taxable profit after R&D Claim (£500,000 – £325,000) | £175,000 |

| Adjusted Corporation Tax liability at 19% rate | £33,250 |

| Corporation Tax saving | £61,750 |

Example of loss-making SME

| Trading Loss (excluding R&D expenditure) | £200,000 |

| Corporation Tax | nil |

| R&D expenditure | £150,000 |

| loss available to be surrendered: Lower of unrelieved trading Loss ( £200,000 + £150,000) = £350,000 or 230% of qualifying R&D expenditure (£150,000 x 230%) = £345,000. | £345,000 |

| Refund from HMRC (14.5% of £345,000 ) | £50,025 |

Can an LLP claim R&D tax credits?

R&D tax credits are claimed in the Company Tax Return and take the form of a deduction in corporation tax. Because LLPs do not pay corporation tax or file a Company Tax Return, they cannot claim R&D tax credits.

How do I claim R&D tax credits?

R&D tax credits are claimed in the Company Tax Return which is filed with HMRC each year.

How far back can I make a claim for R&D tax credits?

The Company Tax Return can be amended to include a claim for up to two years after the end of the accounting period. For example, the return covering the year 1 January 2020-31 December 2020 must be filed by 31 December 2021 but can be amended until 31 December 2022.

What happens if I make a later claim for R&D tax relief?

Once 24 months has elapsed following the end of the accounting period, it is no longer possible to make a claim for R&D tax credits because the Company Tax Return can no longer be amended.

Does my project qualify for R&D tax credits?

To qualify for R&D tax credits, your project must seek to overcome an uncertainty in science or technology. You may be aiming to create a new product or process or changing and developing an existing project or service.

You must be able to explain what the uncertainty was, why the uncertainty existed, how you attempted to overcome the uncertainty and why the knowledge was not already available from an expert in the field.

Tell me more

Click on the links below for more information.

What we do

- Clients outsource the entire process to us, making it as straightforward and seamless as possible.

- Our combined tax, legal and accounting professionals will build and evaluate your R&D claim to maximise the relief available.

- We deal with everything from start to finish, including HMRC approval, the drafting of the claim and accompanying report, and submission of the finalised paperwork.

- No risk to you as we only charge a % of the tax saved on a successful outcome.

More Information

For further information on the R&D reliefs, please subscribe to the relevant Topic below or Contact Us for a free, no obligation meeting.

Contact Details:

How Much Can I Claim?

Case Study

Our client is involved in the production of electronics and hardware systems for the defence sector.

Through discussions with the company director we identified a number of projects both historical and ongoing that would qualify as R&D.

Having carried out a detailed analysis of the costs including staff salaries, externally provided workers and other overheads we were able to identify the appropriate allocation of these costs to the qualifying R&D activites.

A detailed claim document and related calculations were prepared and submitted to HMRC to support the claim.

To date more than £7.8m of enhanced expenditure has been claimed giving an additional tax saving of over £850,000.