EMI options are an effective way of retaining and incentivising key employees and are particularly helpful for growing companies.

The Enterprise Management Incentive (EMI) is a share option scheme with generous tax advantages, designed for smaller companies. Selected employees can be granted options to acquire shares, based on conditions chosen by the company, such as time or performance based measures, or a sale or exit of the company.

EMI options are an effective way of motivating and retaining key employees, particularly at the early stage of company growth where valuation is likely to be low or where there are not sufficient profits to incentivise employees through bonuses. Options must be granted for commercial reasons and not as part of a tax avoidance scheme.

Tax Advantages of EMI Share Schemes

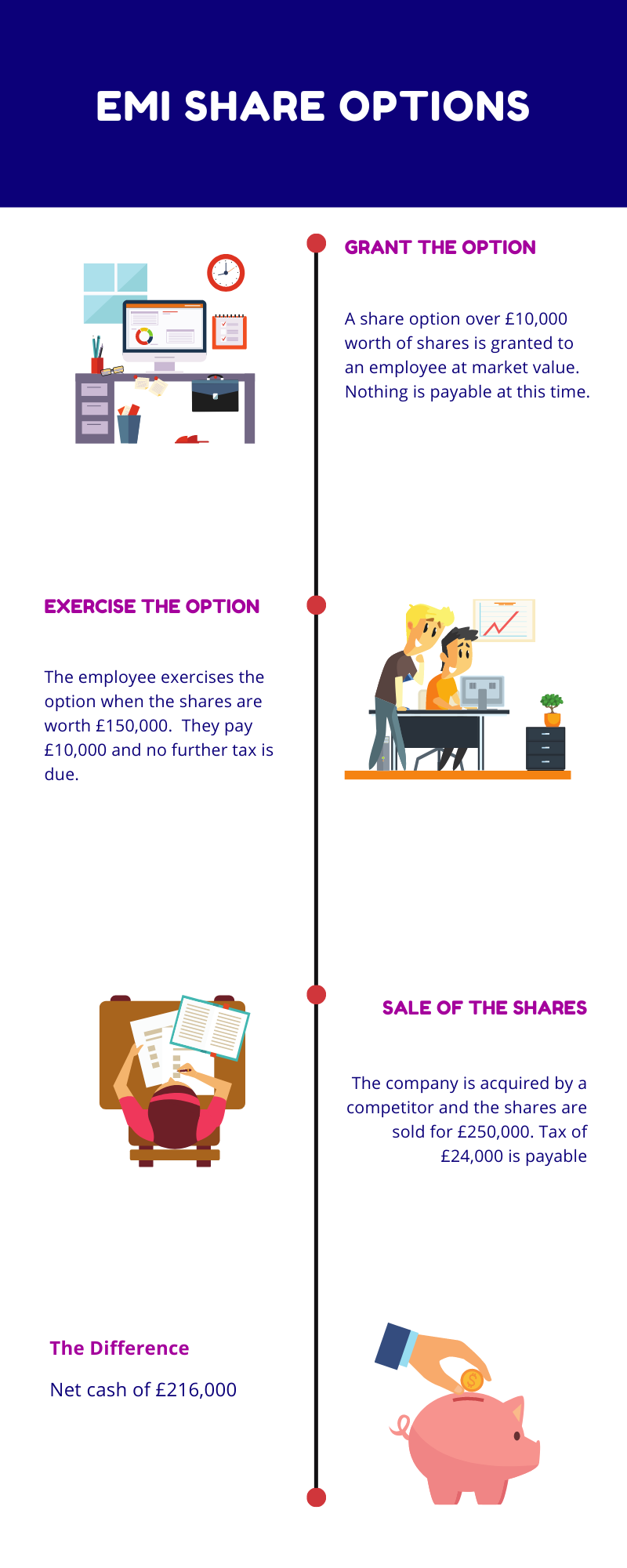

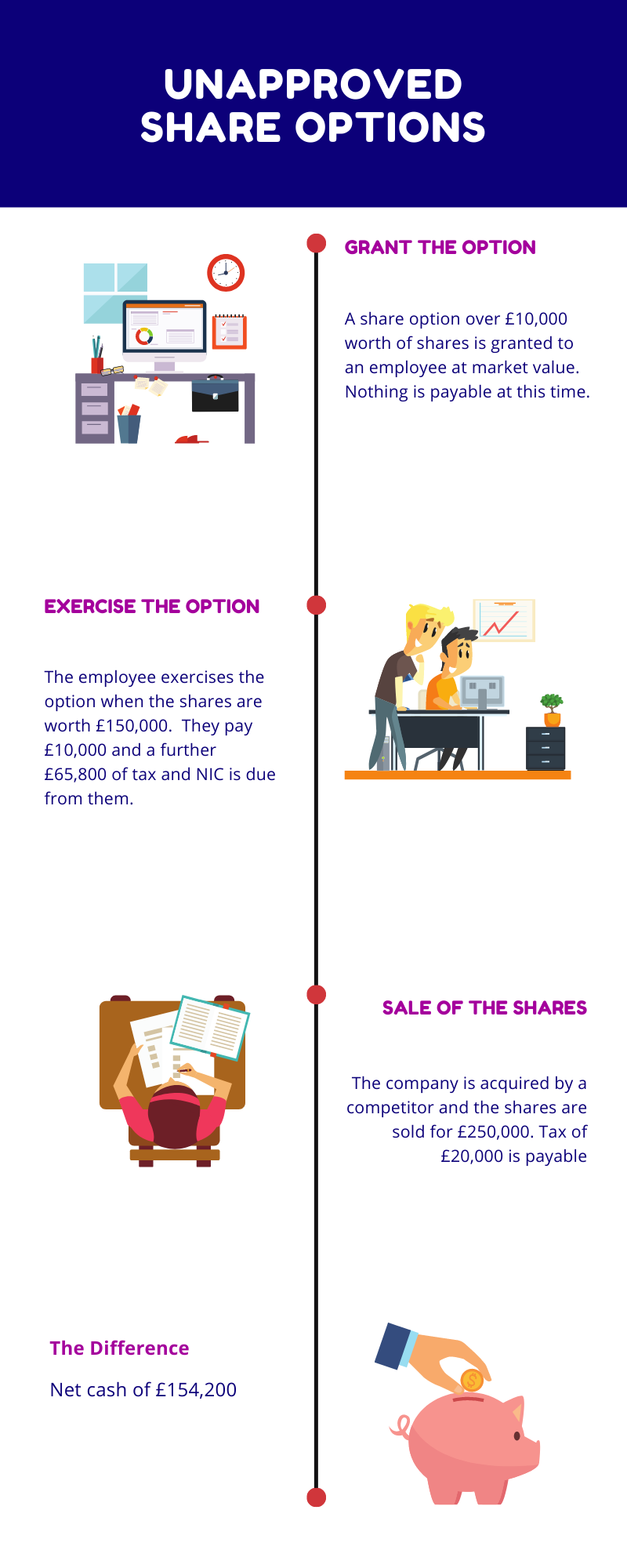

There is no tax charge when granting of the option and, providing the option was not granted at less than market value, there should be no tax charge on exercise. Valuations can be agreed in advance with HMRC: this differs from other share schemes and, as such, is a particular benefit of EMI. Advance assurance can be obtained that HMRC consider the company to qualify for the scheme. This is illustrated in the graphic below:

EMI v’s Unapproved Options

|

|

Any increase in valuation from when the option is granted to when it is exercised is not subject to income tax. There will be a Capital Gains Tax (CGT) charge on sale of the shares if proceeds exceed the exercise price.

There are no minimum shareholding requirements for shares held under EMI to qualify for Business Asset Disposal Relief to reduce the rate of CGT applied on sale to 10%. The normal 12 month minimum holding period requirement for Entrepreneurs’ Relief is specified to include the period the option is held; e.g. if the option is held for two years, the 24 month holding period is met.

Disqualifying Events

Where circumstances change so that the company or the employee are no longer eligible for EMI, this is known as a disqualifying event. Where options are not exercised within 90 days of a disqualifying event, tax benefits are lost.

Disqualifying events may include the company coming under control of another company following a takeover, trading activities changing, or the employee reducing his/her working hours to below the minimum requirement.

Criteria

- The company must have fewer than 250 employees and gross assets of less than £30million.

- It must be independent and not a subsidiary of another company, or controlled by another company.

- It must have only ‘qualifying subsidiaries’.

- There are some ‘excluded trades’.

- There must be a permanent establishment in the UK.

- The company must exist for the purposes of carrying on a qualifying trade or preparing to do so.

- The employee must work for the company for at least 25 hours per week, or 75% of their working time.

- Anyone who controls more than 30% of the ordinary share capital cannot benefit from EMI.

- An individual cannot be granted share options with a value of more than £250,000 in a three year period.

- The limit on the total value of options granted under EMI is £3million.

Reporting Requirements

An option must be reported electronically to HMRC within 92 days of grant. An annual return must also be sent electronically to HMRC.

Next Steps

As a combined accounting and legal firm, Dixcart UK can assist with the entire process of establishing an EMI scheme, from share valuations to the design of the scheme and drafting of the options agreements. For further information please contact your usual Dixcart adviser or a member of our tax team, using the contact details below: